New Jersey Online Casinos, Mobile Sportsbooks Push Back on Tax Increases

Online casinos and mobile sportsbook operators in New Jersey are resisting Gov. Phil Murphy’s (D) proposal for the state to receive a larger share of their earnings.

In his fiscal year 2026 budget speech on Tuesday, Murphy suggested elevating the state tax on iGaming earnings from 15% to 25% and boosting the online sports betting tax from 13% to 25%. Murphy requires additional tax income to support his $58.1 billion spending proposal, the highest ever recorded in New Jersey's history.

Soon after Murphy disclosed his desire for increased online gaming funds for the state, Assemblywoman Rosy Bagolie (D-Essex) along with Sens. John McKeon (D-Essex), Shirley Turner (D-Mercer), and Joseph Vitale (D-Middlesex) introduced matching legislation in their chambers to satisfy the governor.

Assembly Bill 5349 and Senate Bill 5349 would both increase the state tax on gross gaming revenue generated from iGaming and online sports betting. Nonetheless, the law advances with a suggested uniform tax rate of 30%.

Gaming Companies React

The Casino Association of New Jersey, along with the iGaming and online sportsbooks it represents, has expressed its discontent regarding Murphy and the Democratic lawmakers' introduction of bills to increase taxes on iGaming and internet sports earnings.

Certain operators, like FanDuel, contact their customers directly in the Garden State urging them to “Take Action” against tax pressures.

“We need your help,” FanDuel messaged its New Jersey players. “New Jersey just announced a tax hike on online betting — both sports and iGaming. If approved, it would result in a nearly 100% tax increase! With massive, unfair hikes like this, everyone loses.”

FanDuel and BetMGM, in a comparable communication, provided links to a Sports Betting Alliance site where users can enter their details and quickly send a message against New Jersey legislators.

"A 100% tax hike means fewer promos, worse odds, and a less enjoyable market for consumers like me,” the prewritten letter reads. “If legal operators can’t compete, more bettors will turn back to illegal sites that offer better deals but lack protections. This tax hike doesn’t just hurt businesses — it directly impacts me and other responsible bettors.”

The Sports Betting Alliance advocates for lawful, regulated iGaming and sports wagering throughout the US. The four members include BetMGM, DraftKings, FanDuel, and Fanatics.

New Jersey's existing tax system for iGaming and online sports betting is seen as appealing to operators, since the rates are more favorable compared to other legal iGaming states like Delaware, Michigan, Pennsylvania, and Rhode Island.

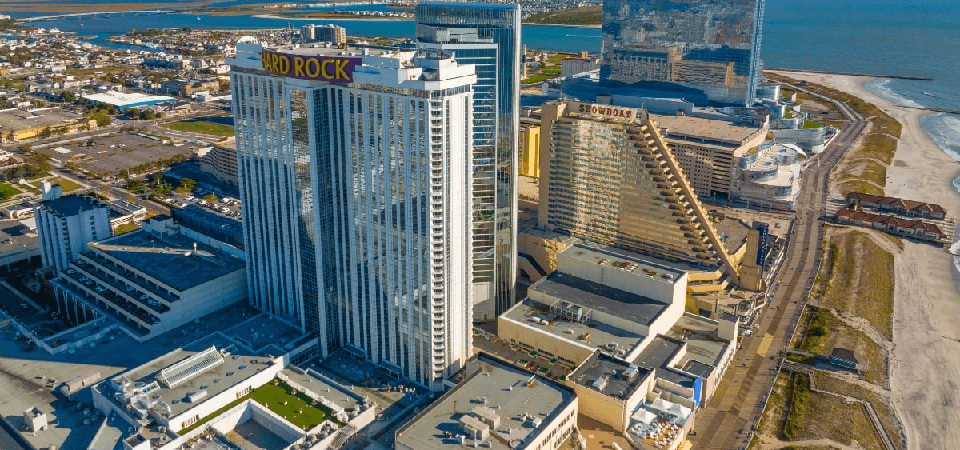

iGaming Surpasses Atlantic City in January 2025

The nine casinos in Atlantic City experienced a decline in live gaming last year. Gross gaming revenue from the physical gaming floors fell by more than 1% to $2.81 billion.

At the same time, iGaming platforms experienced a GGR increase exceeding 24%, reaching $2.38 billion. Bookmakers earned over $1 billion from wagerers, primarily through online transactions.

2025 started with iGaming GGR surpassing the winnings of Atlantic City casinos. Certain analysts think that iGaming operators will surpass physical casinos by 2025, though there may be exceptions in the warmer summer months.